I’ve had the pleasure of judging many startup pitches over the past few years. As a judge, some of the key metrics you use in gauging the growth prospects of a business include the market opportunity, potential business risks, the product, and the business model. Immunization, as a commercial product, ticks the boxes of a good venture.

And with over 16,234,188 Twitter impressions on the hashtag today alone, one can see that vaccines are a debated topic. The tension stems from the fact that whoever wins the race towards finding a coronavirus vaccine would score a perfect touchdown on a once-in-a-lifetime business opportunity.

With that backdrop, let’s review the feasibility of vaccine manufacturing business.

First, there’s a huge market opportunity for vaccine manufacturing

While the global stock markets plunged because of the pandemic, it didn’t affect over 20 companies working on SARS-CoV-2 vaccines and other Covid-19-related products. Instead, their stock prices are rising.

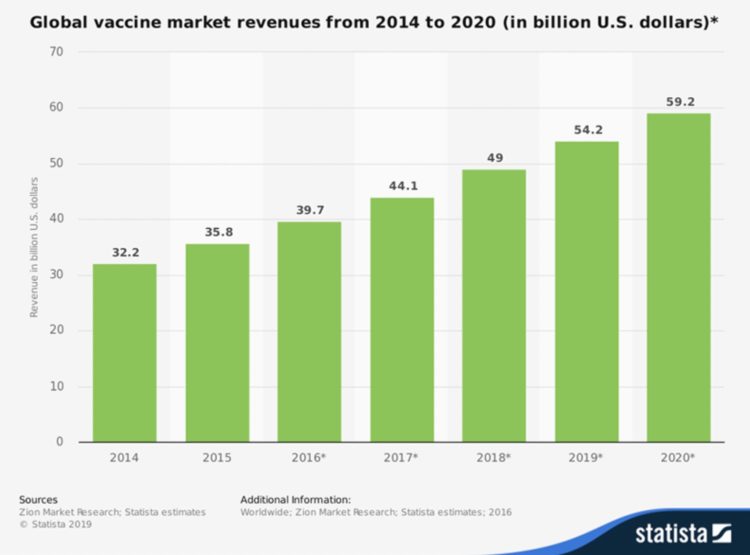

The Pharmaceutical Processing World states that the global vaccine market will reach total revenues of USD $59.2 billion this year 2020. This is almost double the size of the market in 2014 ($32.2 billion), according to a survey from Zion Market Research. And in the United States, vaccines will generate $18 billion this year.

The site further projected that the North American global vaccine market could generate over $24 billion by 2024, dominating the global marketplace. Europe and Asia are estimated to make $16.3 billion and $12.8 billion respectively.

Because of the complex manufacturing processes, high technological and R&D investment, and the costs associated with making vaccines, the market has high barriers to entry; with GlaxoSmithKline, Merck & Co, Sanofi, and Pfizer leading the charge.

In short, the vaccine market will keep growing, and by 2027, the global revenue is expected to reach $62.2 billion, Meticulous Research says.

Second, the vaccine market has been de-risked through governmental policies

In 1986, after people filed many lawsuits against vaccine makers on alleged vaccine-induced injuries, then President of the United States Ronald Reagan signed the National Childhood Vaccine Injury Act (NCVIA) into law.

Congress passed the act because of concerns the threat of financial losses and further liability could keep vaccine manufacturers from developing vaccines.

Under the NCVIA, the National Vaccine Injury Compensation Program (NVICP) provides a federal no-fault rule for compensating vaccine-related injuries or death by allowing an individual or family of an individual who believes a vaccine harmed them or their loved one to file a claim.

That means you can’t sue vaccine makers for any vaccine-related harm. The U.S. Department of Health and Human Services reviews the petitions, and the U.S. Court of Federal Claims determines whether to compensate the petitioner.

Roughly, of every one million doses of all vaccines distributed in the United States from 2006 through 2017, there were about two claims of injury, according to the injury compensation program. And, more than $4 billion in compensation has been paid out by the U.S. government to about 6,429 persons since the program began.

Third, immunization is the best buy in public health

According to a Johns Hopkins University study on the economic value of vaccines, immunization is one of the best buys in public health.

Factually, for every dollar invested in immunization, there is a $16 return. Cumulatively, this results in an economic gain of $586 billion across all the countries included in the study. Note, this data was realized from measuring the return on investment from immunization in 94 countries during the Decade of Vaccines.

The research findings were further corroborated by ex-UNICEF Health Chief, Dr. Mickey Chopra in his January 22, 2013 speech at Davos. Said Chopra in his talk: “We’ve issued bonds on the market to front-load the purchase of large volumes of vaccines, which allows UNICEF to go to manufacturers and say: ‘We can give you a guaranteed volume if you can reduce the price and advance subsidies’. That has allowed us, along with the private-public partnership GAVI [formerly the Global Alliance for Vaccines and Immunisation], to introduce pneumococcal and retro-virus vaccines to the poorest children much more quickly and at a lower cost.”

From the first vaccine introduced in 1796 by the British physician, Edward Jenner, to prevent smallpox, one gets over 54 doses of vaccines by age 18 years today.

Fourth, a robust market opportunity for immunization provides a profitable business model

The New York Times reports that what would have cost $100 in 1986 to vaccinate a child with private insurance now costs $2,192.

Some people have argued that vaccine making is not lucrative because of slim profit margins and shortages, but hard facts show otherwise.

Case in point, Inovio Pharmaceuticals made $208 million from a coronavirus vaccine they haven’t tested on humans. According to the company’s financial statement, Inovio sold over 43 million shares between January 1 and March 11.

More so, biotech firm Moderna’s shares jumped 20% (even as the S&P 500 was down 8.1%) following a media announcement that the company had dosed its first patient with the mRNA vaccine in the Phase 1 study led by the National Institutes of Health. The company gained about $5 billion in market value and raised over $1.25 billion in cash through a public share offering.

Massachusetts-based Moderna does not have any product on the market. And according to experts, the mRNA vaccine, although exciting, is unproven. Barrons writes, “no mRNA vaccines have ever been approved by the Food and Drug Administration.”

Vaccines as cash crops are unreasonable to effective public health results

The prospects of an effective vaccine helping to resolve the pandemic are huge. And so are the risks and long-term cost of disregarding the warning bells of the threat in having businesses compete to deliver public health outcomes with profit motives.

Alarmingly, standard protocols have been bypassed by different vaccine makers in a scramble to market products that are too good to be true.

Take, for instance, the Moderna vaccine trial. Aside from the fact the technology is unproven, they bypassed critical safety standards such as animal trials and moved on to test a new therapeutic substance on the human body. Experts have criticized the company for making rosy predictions and lack of transparency, saying that based on available data, the formulation is questionable.

Also, former SEC Lawyer Jacob Frankel appeared on CNBC calling for a criminal investigation into Moderna, and trading suspension. Following that incident, speculators shorted the stocks, and investors started trading off their shares.

True, there must be a sense of urgency in finding tools and medications that can end the pandemic. But that should never be an excuse to throw caution to the wind by compromising standards or making room for fraud. The signs are creeping up in different quarters. We saw the news of fake test kits in Tanzania, and Belgium banned rapid testing kits for unreliable results.

History repeats itself when we don’t learn the first time. The story of Elizabeth Holmes’ Theranos should serve as an excellent case study. When the company turned into a full-blown scandal, investors and regulators claimed Theranos misled and deceived them.

The stakes are still low for SARS-CoV-2 vaccine production. Policymakers and regulators must awaken to the responsibility of ensuring the business of vaccine production does not erode the science.