Ghana-based FinTech startup FX Kudi is tackling the $140-170 billion Small and Medium Enterprises credit financing value gap with their money transfer and remittance technology.

The historical challenge of SME financing in Africa is well-known and documented. Africa supports 400 companies with annual revenues of $1 billion—and they are, on average, both faster growing and more profitable than their global peers, according to McKinsey. Yet, the quantum of working capital deficit for SMEs is an issue of significant concern.

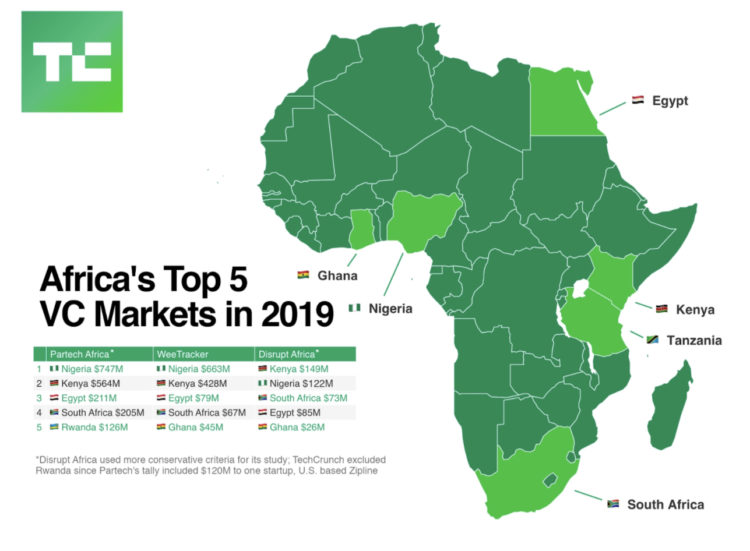

In a report released by the global technology investment company Partech, African startups raised $2 billion in VC funding in 2019. When you review the financing details, you will notice a significant disparity that technology entrepreneurs have termed “the missing middle.” According to the reporters, of all 427 startups that raised funding throughout 2019, a mere 6% accounted for 83% of the total investments. Further, over 75% of the deals took place in three markets—Nigeria, Kenya, and South Africa.

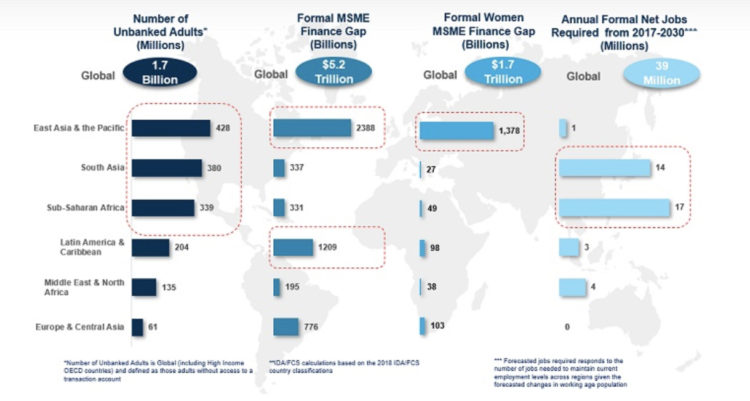

Small and Medium-sized Enterprises, referred to as “the missing middle,” lack financial instruments to scale their operations. In analyzing the causes of this funding gap, investment analysts have faulted these firms’ inability to give the required collateral, such as equity, a mortgage, or equipment, for loans from African banks and the fact they are too big to qualify for microfinance.

Research shows that in the Organization for Economic Cooperation and Development (OECD) region, SMEs account for 99 percent of all firms, 70 percent of job creation, and generate between 50 to 60 percent value-added on average. Which means, if they had the financial instruments to power their operations, the results would be incredible.

Bridging the access to funding gaps requires fresh and bold thinking.

Development Finance Institutions (DFIs), governments, and impact investors have tried to bridge the gap between banks and the real economy by creating asset financing instruments. But the challenge with such interventions is that they are usually expensive.

On their part, the World Bank introduced SME support initiatives such as the design and set up of credit guarantee schemes. The project estimates the number and volume of MSME loans in Morocco increased by 88% and 18% since 2011. But there’s still a noticeable shortcoming to these efforts in that few SMEs can access the services, resulting in a value gap of $19 billion in countries like Kenya.

FXKudi, a product of King Solomon’s Group of Companies, recognizes this deficit as an opportunity to serve the SME market with innovative financial solutions. They realized in their research that the late payment for services and long invoice maturity, translating to significant cash flow deficits for small businesses, hampers short-term agility and long-term growth and investment. Seizing that opportunity, the team has launched a simple, SME-friendly money transfer service that serves as a reliable payment infrastructure, providing SMEs with secure, fast, and convenient payment options.

FX Kudi makes it easy for Small and Medium Enterprises to send and receive money from anywhere in the world without hassle. You can easily create an account, connect your wallet or Mobile Money service, and start sending money.

With FXKudi, SMEs can take their businesses closer to their clients with multiple means of accepting payments. Their payment processing infrastructure gives clients great comfort in remittances. And added to their great transaction rates and quick account reconciliation processes, this team is positioning itself as a formidable partner to help SMEs fast-track their business growth.

But that’s not all. You can better track your online transactions with FX Kudi Virtual Card, a digital wallet for savvy and security-conscious people. FXKudi Virtual Mastercard gives you a digital substitute for the usual plastic cards.

The possibilities are numerous. You can customize your online shopping using different Virtual Cards, get up to 10 active cards per user, choose Virtual Cards that suit you best, and get an instant free-of-charge load with zero monthly fees.

Start Accepting Payments Worldwide

With just a single setup, FXKudi gives you a safe means of collecting payments from your customers. Forget the unexpected charges of correspondent banks and payment delays in some other networks. You can also get paid in different currencies, have instant settlements at reasonable fees, and give your clients multiple modes of payment (cards, Mobile Money & bank transfer).